Nvidia reported on the results of the fourth quarter, which exceeded Wall Street's forecasts in terms of earnings and sales, stating that revenues in the current quarter will be better than expected, despite increased expectations for mass growth. Nvidia's shares rose by approximately 10%.

Nvidia has become the main beneficiary of the recent obsession of the technology industry with large artificial intelligence models that run on the company's expensive graphics processors for servers.

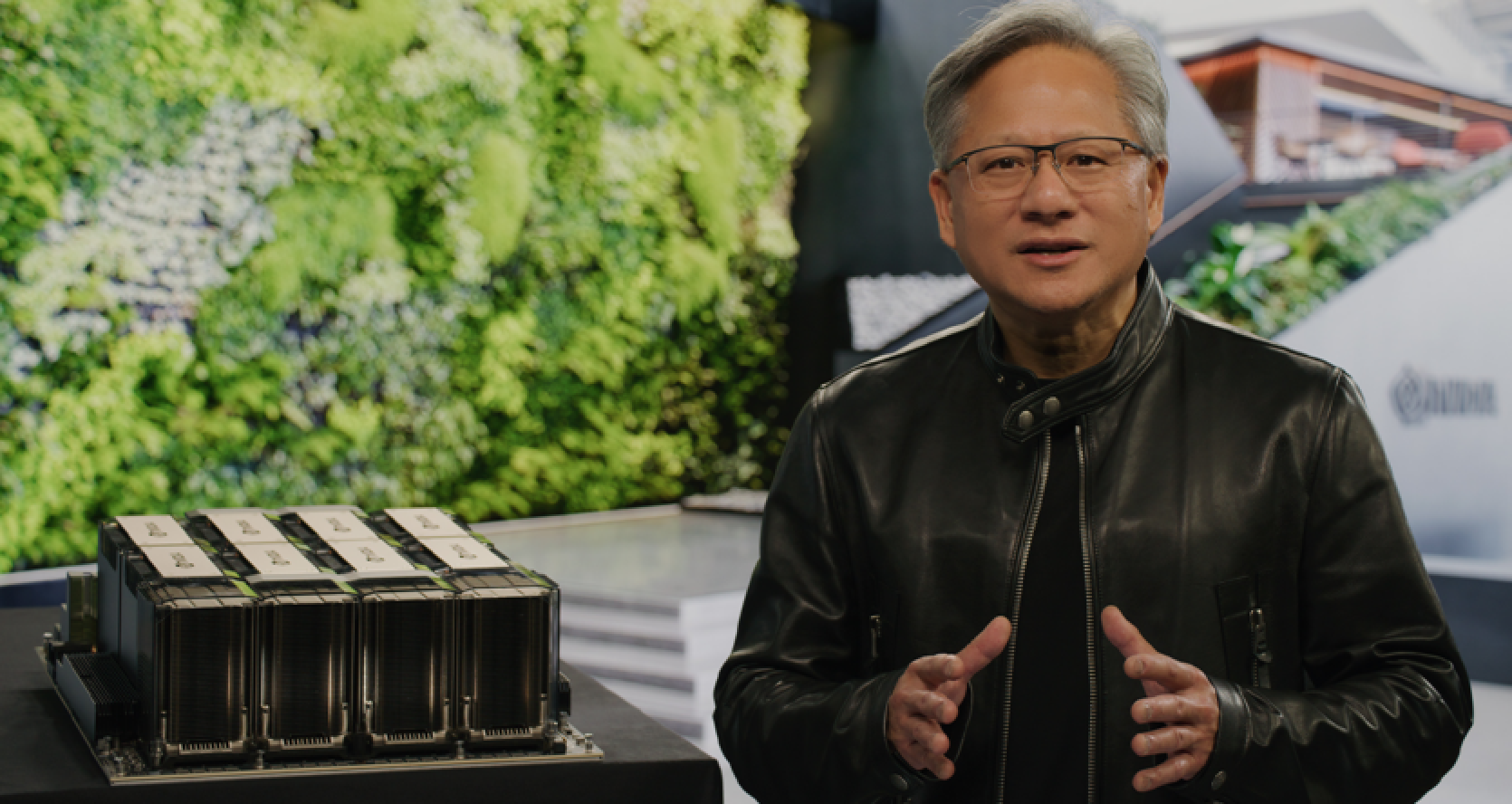

Nvidia CEO Jensen Huang, in a conversation with analysts, addressed investors' concerns that the company may not be able to sustain such growth or sales levels throughout the year.

Nvidia's net profit for the quarter was $12.29 billion, or $4.93 per share, which is a 769% increase from last year when it was $1.41 billion, or 57 cents per share. Nvidia's total revenue increased by 265% compared to last year due to high sales of AI chips for servers, particularly the Hopper and H100 product line.

Sales of the company's data center business, which now accounts for a large part of Nvidia's revenue, increased by 409% to $18.40 billion. The majority of the company's data center sales came from large cloud providers. Nvidia also stated that its data center revenues were affected by recent US restrictions on the export of advanced semiconductors for AI to China, as reported by CNBC.

The company's gaming business, which includes video cards for laptops and PCs, only grew by 56% compared to last year to $2.87 billion. Video cards for gaming were Nvidia's main business before its AI chips started gaining traction, and some of Nvidia's video cards can be used for AI.

Nvidia's smaller businesses did not show the same rapid growth. Its automotive-related business declined by 4% to $281 million, while OEM and other business, which includes cryptographic chips, grew by 7% to $90 million. Nvidia's business producing graphics equipment for professional applications grew by 105% to $463 million.

Comments (0)

There are no comments for now