Nvidia's market value has now surpassed $3 trillion.

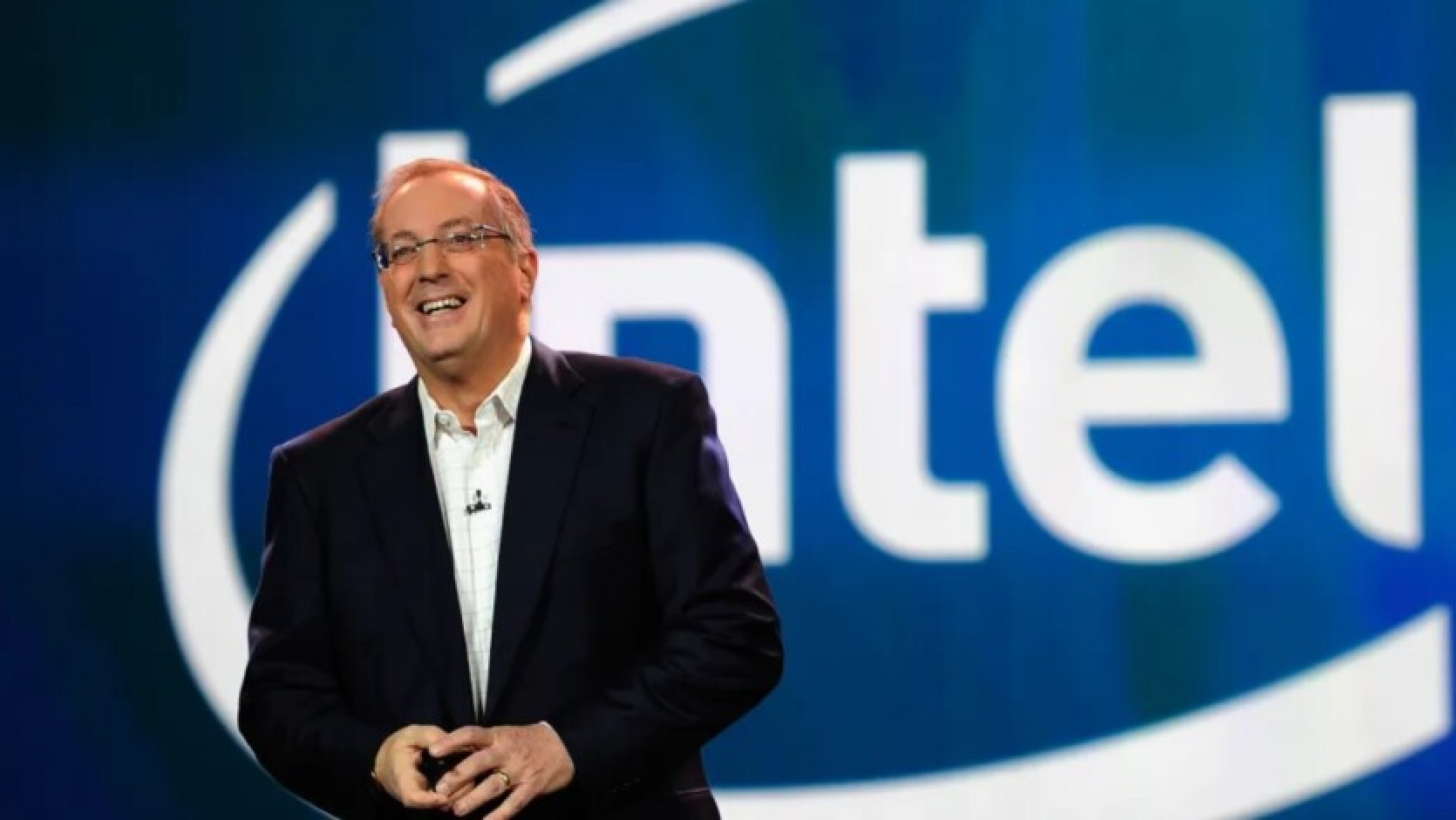

According to the New York Times, in 2005, former Intel CEO Paul Otellini proposed to the board to acquire Nvidia for $20 billion — a deal that could have been the most expensive in Intel's history, but the board had concerns regarding the integration of the company and the potential for financial losses.

Ultimately, Otellini backed down, and the board decided to invest in the internal graphics project Larabee, which at that time was being led by Pat Gelsinger (now Intel's CEO). The project utilized Intel x86 technologies, and the GPU was a kind of hybrid between a CPU and GPU — it was eventually discontinued, although the idea resurfaced in the form of the Xe and Arc projects.

In 2016 and 2019, Intel acquired Nervana Systems, Movidius, and Habana Labs, respectively, to focus on artificial intelligence — however, none of them could compete with Nvidia's current standing. Now, under the leadership of Jensen Huang, Nvidia is the market leader with a valuation exceeding $3 trillion. Intel has an AI chip called Gaudi 3, which is marketed as a cheaper alternative to Nvidia’s offerings, but it seems Intel has unfortunately missed the AI boat.

Moreover, this isn't the only instance where Intel has missed opportunities in AI — in 2017 and 2018, the company had a chance to acquire a stake in the then-tiny OpenAI, but then-CEO Bob Swan declined the deal, believing that AI models were far from reaching a broad audience.

Now, Intel finds itself in a situation where it could become a target for acquisition (at least, there are rumors of a takeover by Qualcomm).

The company is undergoing one of the largest crises in its 50-year history, which has led it to announce the layoff of thousands of employees and suspend dividend payments as part of cost-saving measures. In September, Intel stated that it plans to separate its chip manufacturing and design departments and pause construction on some factories.

For comparison, just in 2020, Intel's market value reached $290 billion, while this year the company’s stock has plummeted by a staggering 60%.

Comments (0)

There are no comments for now