The suspension of the provision in the Law on the Unified Social Contribution (USC), which allowed individual entrepreneurs to pay it voluntarily during the war, is outlined in paragraph 3 of the final provisions of the state budget project.

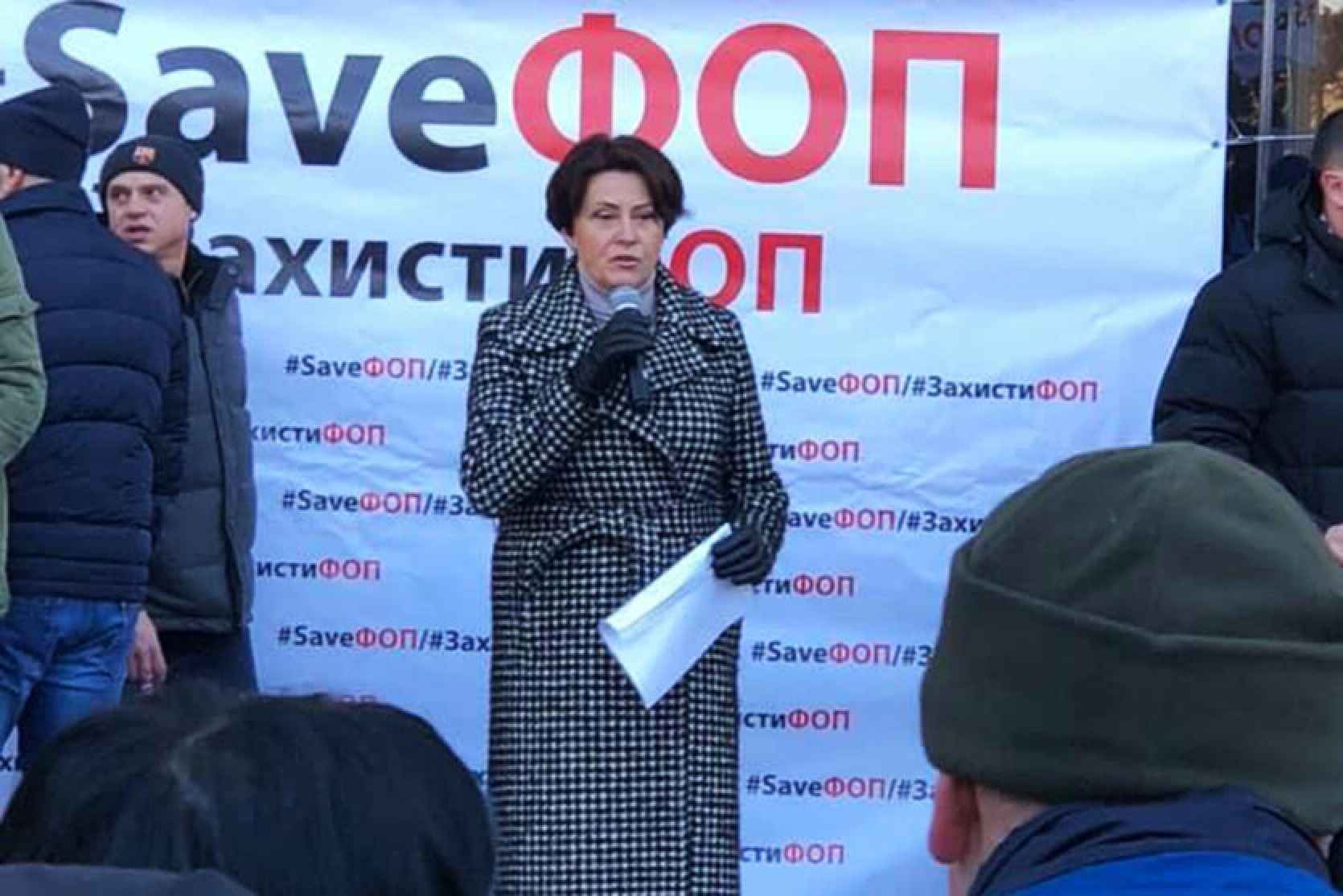

This was reported by the chairperson of the Verkhovna Rada of Ukraine's Committee on Taxation and Customs Policy, Nina Yuzhanina, on Telegram. The deputy reminds that the change introduced at the beginning of Russia's full-scale invasion of Ukraine allowed for the voluntary payment of the USC by individual entrepreneurs from March 1, 2022, until the end of martial law and for 12 months thereafter. Individual entrepreneurs still have the right to not accrue, calculate, or pay the USC for themselves.

Nina Yuzhanina adds that the tax authorities have emphasized all this time that the payment of USC affects the accumulation of insurance experience. Therefore, with the adoption of the presented budget draft, this provision will signify the full restoration of the pre-war tax system.

Previously, the publication “RBK-Ukraine” reported, citing the explanatory note to the draft № 12000 budget for 2025. Yuzhanina's announcement was an official confirmation of the government's intention to revoke the voluntary aspect of the USC. The draft law states that there will be a “restoration of the payment of the unified social contribution by individual entrepreneurs, particularly those who have chosen the simplified taxation system.”

The publication reminds that the minimum size of the USC is 22% of the minimum wage. Since this value will not change in 2025, calculations are based on the amount of ₴8000. Therefore, individual entrepreneurs will be obligated to pay ₴1760 monthly, or ₴21,120 annually.

Additionally, the tax increase bill stipulates that starting from October 1, 2024, individual entrepreneurs will pay a military levy of 10% of the minimum wage for groups 1, 2, and 4, while group 3 entrepreneurs will owe 1%.

Comments (0)

There are no comments for now