In recent days, mobile processor manufacturer Qualcomm has expressed its intention to acquire Intel. This was reported by The Wall Street Journal citing informed sources.

The acquisition of Intel, which has a market value of approximately $90 billion, has become possible due to one of the largest crises in the fifty-year history of the chip manufacturer. Sources indicate that the deal is still far from realization. Even if Intel agrees, such a large-scale transaction will undoubtedly attract the attention of antitrust regulators. To finalize the deal, Qualcomm may need to sell assets or parts of Intel to other buyers.

Shares of Intel, once the world's most valuable chip company, have decreased by about 60% this year. Back in 2020, the company's market value exceeded $290 billion. Qualcomm's current worth is about $185 billion, with its shares rising approximately 17% this year. The acquisition would significantly broaden Qualcomm's horizons and complement its mobile chip business with Intel processors for laptops, PCs, servers, and embedded systems.

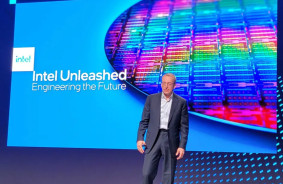

Under the leadership of Cristiano Amon, Qualcomm collaborated with Intel on the potential manufacturing of its chips at Intel's factories. However, Qualcomm halted these efforts due to technical reasons. This acquisition attempt by Qualcomm unfolds against the backdrop of over three years of attempts by Intel, under Pat Gelsinger’s leadership, to overcome the crisis that have yet to yield significant results. The manufacturing division is currently unprofitable and receives few client orders beyond Intel itself since Gelsinger opened the factories to third-party chip developers three years ago.

In August, following a disappointing quarterly report, Intel announced plans to lay off thousands of employees and suspend dividend payments as cost-saving measures. Last month, the company unveiled a plan to cut expenses by over $10 billion by 2025 and reported a $1.6 billion loss for the second quarter, compared to a $1.5 billion profit during the same period last year.

At the end of August, director Lip-Bu Tan unexpectedly left Intel's board. His departure came as a shock to many who considered him a potential future leader of part of Intel's business if the company were to split.

Earlier this week, Intel announced plans to separate its chip manufacturing and design divisions, suspend factory construction in Germany and Poland for two years, as well as the construction of a factory in Malaysia until demand recovers. These steps, including reaching a multibillion-dollar agreement for cloud chip manufacturing for Amazon, occurred after Intel’s board meeting in early September, where the company’s strategy was discussed.

Comments (0)

There are no comments for now