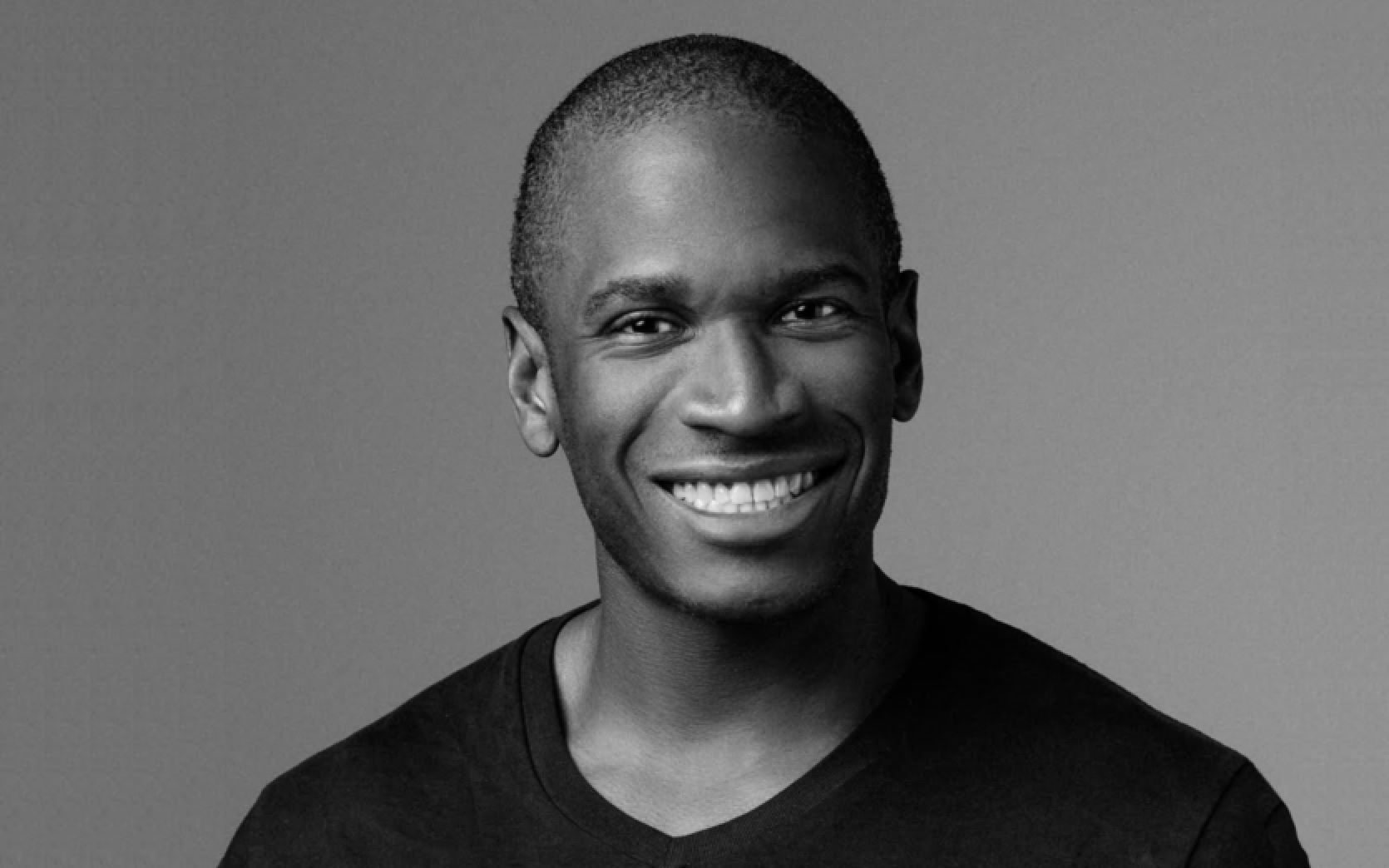

The well-known American entrepreneur, co-founder and former director of the BitMEX exchange, Arthur Hayes released a new essay titled "Onward, Bitcoin," in which he stated that "monetary chemotherapy" in the Chinese economy will lead to increases in Bitcoin and other asset prices. Hayes pointed out that global economic crises and monetary stimuli drive up demand for the leading cryptocurrency against a backdrop of weakening fiat currencies, particularly the US dollar.

According to the businessman, the Chinese government, in its attempts to rescue the stagnant real estate market, will be forced to invest hundreds of billions of dollars into its economy. This will have an impact on Bitcoin.

The decline in loan demand renders traditional measures—such as lowering interest rates and moderate budget deficits—ineffective. To prevent deflation, governments resort to strong monetary stimuli: bank recapitalizations and quantitative easing (QE)—the central bank prints money, purchases government debt, and stimulates the economy. Asset prices, such as stocks and real estate, rise, prompting people to invest again, but this also increases inflation. Such measures support asset prices but do not necessarily improve the real economy—middle and low-income classes suffer from rising prices, while financial elites benefit. Thus, Bitcoin and cryptocurrency prices are likely to rise alongside increasing fiat volumes.

"Bitcoin is not an alien concept to the Chinese, and they won't let it remain idle. P2P trading is reviving in China, the yuan is weakening, and cryptocurrencies are thriving despite government bans," Hayes wrote.

To better understand what is happening in China, he compared it with financial crises in three other major economies: the United States, Japan, and the European Union (EU). Each of these countries experienced a severe financial situation triggered by a "bursting bubble" in the real estate market.

- Japan in 1989

- The United States in 2008

- The EU in 2011

He noted that the growing inflationary risks in China, which has been affected by the real estate market collapse, along with the skepticism of the younger generation towards government stimulus programs in China, Japan, and the US, will increase the popularity of cryptocurrencies.

Additionally, in light of news about a potential new debt for China exceeding 10 trillion yuan (approximately $1.4 trillion), interest in Bitcoin as a hedge against currency devaluation may rise among traders.

Hayes emphasized that past experiences indicate Bitcoin has shown significant growth following periods of substantial national debt and devaluation. He reminded that in 2015, after the yuan’s devaluation, Bitcoin's price nearly quintupled.

"After the shock devaluation of the yuan by the People's Bank of China, Bitcoin's price surged from $135 to $600—almost five times in less than three months," wrote the crypto investor.

As of July 2024, new home prices in China reached their lowest level in nine years. Despite numerous incentives, including lower mortgage rates and reduced home buying costs, the government failed to stabilize the market. Prices fell by 4.9% year-on-year, marking the largest drop since June 2015. Only two cities, Shanghai and Xi’an, saw slight increases in new home prices.

According to a survey by the People's Bank of China, 23.2% of the population expects further declines in housing prices in the third quarter—a record high since 2013.

Source: Reuters

Comments (0)

There are no comments for now